Use Case: Banking & Financial Institutions

Subject area: The EMOTIONAL Fingerprint® of a group of employees of a Financial Institution to diagnose and improve critical issues that deliver results.

By asking your sellers the right questions, extracting & accumulating scientific results over time, you can diagnose and measure the evolution of an issue that you want to improve.

Financial Institutions – Critical Issues

Customer Satisfaction & Retention

Financial Products or Services – Key Success Factors

Salesforce & Cross-selling

High-Value Customers

Fraud & Theft

Cyber-Security

Physical Security

Human Resources Issues

Training & Development

Staff & Management Underperformance & Engagement

Communication, Marketing & Advertising Strategies

Innovation

Business Event

The Employees have a permanent contact and interaction with clients and potential customers and receives valuable information that is not easily processed. The ETC interview process allows us to extract and calculate emotional variations expressed in questions from those Critical Issues and diagnose the severity of the situation.

Actors & Roles

(CM) – Company Management – Responsible of ETC Performance Project in the client side.

(SP) – Staff & Management – Financial Institution Employee.

(EP) – ETC Partner – Expert Consultant to Coordinate the Process.

(EX) – Examiner – Scores the manually the Good Employee/Candidate.

(OB) – Observer – Quality Assurance.

(EE) – ETC Experts – Worldwide field specialits (AI-Predictive Models, GDPR, Security, etc.)

ETC Performance Diagnose Method

a. CM & EP – Define Critical Issues to Observe, Diagnose & Improve (Scope & Approach). Data & Metrics that support the current situation.

b. CM & EP – Generate relevant questions per each Critical Issue to be measured and expected improved results.

c. EP – Setup the ETC Employee & Corp Scan solution to perform interviews.

d. CM & EP – Select a Staff or Management segment and frequency to initiate interviews.

e. SP – Employees perform the Video Recording interviews.

f. EP – Critical Issues Data Collection to Diagnose the severity of each Critical Issue and generate a Report over findings.

g. EE – Perform Predictive Modeling (machine learing).

h. CM & EP – Integrate Strategies & Work Plans to Improve.

i. CM, EX & EP – Adjust Questions to fine-tune and confirm trends & patterns.

i. EX, EP & EE – Evaluate and Present to the client the Results.

Financial Institution Sample Metrics (Predictive Models Correlation)

Record Data Entry Values (Diagnose) and Evolution over the project (Improve).

Revenue Variations: Month-over-month, year-over-year sales growth?

New Client Leads by source: Where your customers are coming from?

Lead Response Time: How long does the lead processing take?

Average Product Value: What is the Average Contract Value?

Annual Sales Value: What is the annual value of your clients?

Average Sales Cycle Length: How long does it take to close a lead?

Outbound-Calls: Which weekdays are the most promising?

Outbound-Calls Contact Rate: Which sales representatives perform best?

The volume of Business per employee

Operating Profit Per Employee

Sales Per Branch

Training Hours per employee

Number Of Workflow Processes Implemented

Net Interest Margin

Return on Assets

Return on Equity

Loan-to-Assets Ratio

Risk-Adjusted Return on Capital

Efficiency Ratio

Loans to Deposits Ratio

Yield on Loans

Allowance for Loan and Lease Losses to Loans

Cost of Total Deposits

ETC Performance Consulting – Output Summary

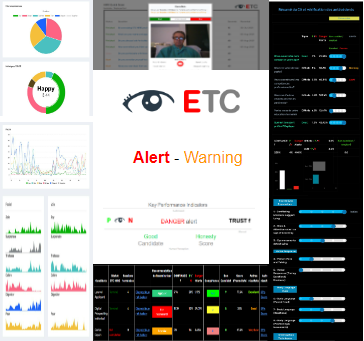

ETC AI generates the EMOTIONAL Fingerprint® at different dimensions and levels, Employees to improve their performance the Corp Climate, Critical Issues, and the organization’s Salesforce as a team.

Financial Institutions – Job Types

Bank teller

Responsible for helping members cash checks, withdraw money, move transactions to different accounts, create checking and savings accounts, and provide checks to customers. Bank tellers should have ethical standards and practice confidentiality to uphold member account information.

They should also have good problem-solving skills and be able to communicate verbally.

Banker

Helping clients acquire loans through the bank. By doing this, they aim to help the bank earn money by applying fees and interest rates to those loans. Bankers can also meet with clients for a paid consultation to advise them on financial matters such as investments and capital resources.

They also need verbal and written communication skills, problem-solving skills, and risk analysis knowledge, and should be technologically savvy.

Loan processor

Use their knowledge of risk analysis and financial statements to review loan applications and approve or deny applicants for the loans they apply for. Their primary duty is to protect the financial institution and its monetary assets by only approving candidates who have an good financial history.

Mortgage consultant

Mortgage consultants usually work in freelance positions or as sole-business proprietors. Their job is to help companies or individuals identify their mortgage needs, assess their financial history, and determine the type of mortgage they could afford. Further, they help their clients determine which lending institutions would most likely give them a loan based on their financial history.

Investment representative

They provide clients with financial advice regarding investments, typically for a fee. They must also perform sales-related duties to market their institution’s financial products and services.

To become an investment representative, you need to earn a bachelor’s degree in accounting, business administration, economics, or finance. You may also need to obtain a license with the Financial Industry Regulatory Authority.

Credit analyst

They are responsible for reviewing an applicant’s financial history and credit score. The main difference between a credit analyst and other professions like a loan processor is that they can only recommend whether or not an applicant should be approved. Credit analysts usually have extensive knowledge of statistics, financial statements, and ratio analysis.

Investment banker

Provide financial advice to clients relating to investment opportunities, but they can also help instrument the process by overseeing the liquidation of assets to reduce debt and other factors. Investment bankers should have a bachelor’s degree at the entry level, with more senior roles requiring a master’s degree.

Financial Advisor

Help clients determine their financial goals and the best means to achieve them. This entails trading for them in the stock markets, reviewing their financial history, and providing them with advice for the best decisions they can make for their finances.

Financial advisor candidates need at least a bachelor’s degree in economics, statistics, finance, or business. They should also have a few years of experience in a finance-related role, like an investment specialist/banker or credit analyst.

Financial analyst

Use their expertise to guide businesses and clients on when, where, and how to invest. Financial analysts typically work for major corporations, financial institutions, insurance companies, and banks.

For senior positions, most employers prefer that you have a master’s degree.

Asset manager

Works for individual clients as a sole proprietor or a part of a bank or financial institution. They are responsible for reviewing their client’s financial portfolios and monitoring the stock market to determine the best investment decisions for their client.

They also help them invest in stock and other assets and predict what will give them financial growth. This job entails a lot of time and research to make informed decisions about potential investment opportunities on behalf of the client.

Underwriter

Responsible for reviewing a loan application and assessing whether or not the applicant can afford to pay off the loan. Further, they draft up a contract for approved borrowers that outlines the loan amount and payment rates expected by their company.

Underwriters may work at insurance companies, financial institutions, banks, and other lending companies.

Internal auditor

Complete routine assessments of the bank’s internal procedures, loan and spending habits, employment expenses, and other risk management factors. Their main goal is to determine whether the bank complies with laws and regulations.

Investment banking analyst

Works as a liaison between business owners and potential investors to help businesses confirm their financial health. These professionals also help businesses increase investor relationships by helping them smartly manage their finances.

Loan officer

They are responsible for gaining expert knowledge of all the loan options their employer offers to borrowers. They also meet with clients, businesses, and individuals to determine their eligibility by reviewing their financial statements. This information can give clients quotes on loan rates and sums available to them.

Bankers Desirables Skills

Analytical skills

it’s a simple truth that you won’t advance very far in banking and finance unless you possess the analytical skills to identify trends, patterns, and definitive conclusions from the data you’ll have exposure to.

Commercial awareness

With the ability to anticipate financial trends and future business developments in the corporate world, it’s also necessary to understand how businesses operate and what drives them, mainly if you are working directly with them. While working with a client in a particular industry, you need to understand anything about that industry’s climate, risks, and potential change factors.

Attention to detail

An educated eye for detail is another requisite for banking, whether noticing particular trends or activities that nobody else has or producing complex financial reports for senior management.

Determination

The banking industry is a ruthless and very competitive environment, where you’ll have to overcome many obstacles on your journey from wide-eyed intern to seasoned account manager.

Work ethic

Banking is not for the lazy or the unmotivated. It is no secret that bankers work long hours. Indeed, junior bankers at top Financial Institutions work extended hours, leading to extreme burnout and high-stress levels.

Confidence

The general perception of the industry is that you need to be confident to succeed.

Technical skills

As with most industries in the digital age, most of the decisions you make will be based on data analysis. Therefore, you’ll need to be tech-savvy to access and process that data, communicate, and perform well.

Bankers work with specialized software, so take every opportunity during internships or placements.

Sample Questions to understand your Salespeople skills and profile:

What do you do to open a client account? Describe

When you don’t close an important account to meet your goals, what do you do?

How do you make sure you always meet your sales goals?

What do you think about automated tools (CRM) to improve performance?

Performance Consulting Deliverables and Benefits

-

“Cultural Risk & Loss Prevention” report based on the countries where the company operates.

-

Reports of each Employee and Candidates included the Examiner’s evaluation.

-

Diagnosis of the critical issues (Opportunities for Improvement) presented quarterly.

-

Detailed Action Plan and follow-up with ETC and company metrics, as well as job performance to correlate variables that increase profits.

Benefits: Substantial improvement of the Organizational Climate, Critical Issues improvement, and at least XX% increase in profits at the end of the project.